The market capitalization of the US stock market is a crucial metric that provides investors with a comprehensive view of the total value of all publicly-traded companies within the United States. It represents the market's overall health and can be a valuable indicator of economic trends and investment opportunities. In this article, we will delve into what market capitalization is, how it is calculated, and its significance in the context of the US stock market.

What is Market Capitalization?

Market capitalization, also known as market cap, is the total value of a company's outstanding shares of stock. It is calculated by multiplying the number of shares outstanding by the current market price of the stock. This figure represents the total investment value of the company in the stock market.

For example, if a company has 100 million shares outstanding and each share is trading at

How is Market Capitalization Calculated?

The formula for calculating market capitalization is straightforward:

Market Capitalization = Number of Outstanding Shares × Current Market Price per Share

This calculation can be applied to individual companies or to an entire stock market, such as the US stock market. When calculating the market capitalization of an entire market, all the outstanding shares of all companies listed on the market are taken into account.

Significance of Market Capitalization in the US Stock Market

The market capitalization of the US stock market is a critical metric for several reasons:

Economic Indicator: It provides insight into the overall health and size of the US economy. A rising market cap often indicates a growing economy, while a falling market cap may suggest economic challenges.

Investment Opportunities: It helps investors identify companies with high growth potential. Companies with a higher market cap are often considered more stable and mature, while those with a lower market cap may offer more growth opportunities but also come with higher risk.

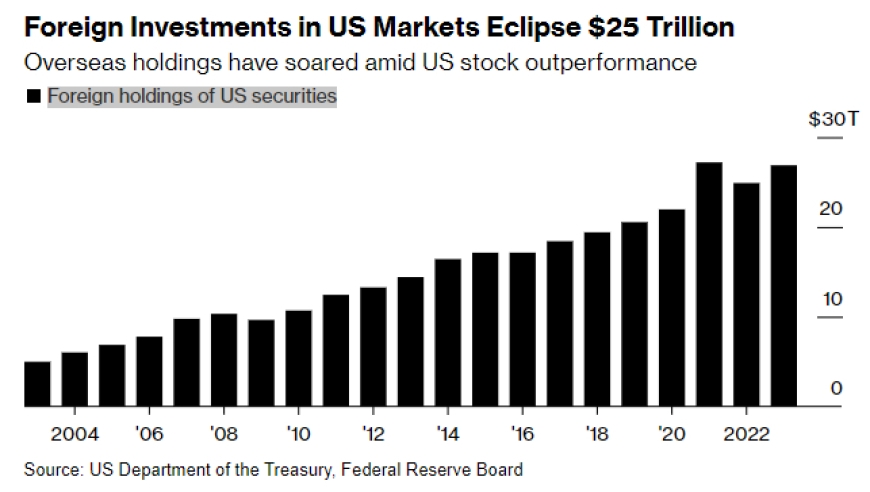

Market Size: The US stock market is the largest in the world, with a market capitalization of over $30 trillion. This size attracts investors from around the globe and provides ample liquidity for trading.

Case Study: S&P 500 Index

One of the most well-known benchmarks in the US stock market is the S&P 500 Index. This index tracks the performance of 500 large companies listed on stock exchanges in the United States. The market capitalization of the S&P 500 provides a snapshot of the overall performance of the US stock market.

As of [insert current date], the S&P 500 has a market capitalization of over $30 trillion. This represents the combined value of all the companies in the index. By analyzing the market cap of the S&P 500, investors can gain valuable insights into the overall performance of the US stock market and make informed investment decisions.

Conclusion

Understanding the market capitalization of the US stock market is essential for investors and financial professionals. It provides a comprehensive view of the overall value of the market and serves as a valuable indicator of economic trends and investment opportunities. By analyzing market cap, investors can make informed decisions and identify potential investment targets.

nasdaq composite